Corporate Office

INVEST SMARTLY HERE

Rental Property

Loans

We offer flexible investment loans with permanent financing for long-term and vacation rental properties—all through a seamless loan application process.

CASH-OUT. REFINANCE. PURCHASE

Vacation Rental

Property Loans

Tailored specifically for vacation rentals, our loan program offers competitive terms and expert support to help you maximize your investment success. Enjoy a straightforward application process with clear guidance at every step.

INVEST WITH CONFIDENCE

Stable Rental Financing

If you aim to generate passive income from commercial real estate—whether through long-term leases or short-term vacation rentals—the initial investment may seem overwhelming. Fortunately, a variety of financing options are available to minimize upfront costs and help you start your journey as a real estate investor with a straightforward loan application process.What Is an Investment Property?

Understanding Income Properties

An investment property is purchased with the primary objective of generating income, whether through short-term rentals, long-term leases, or profitable sales, such as house flipping. These properties can be held for a few months or many years and may include residential homes, multifamily units, or commercial buildings. Our platform offers clear guidance, efficient application processes, and state-compliant financing options, empowering investors to optimize their portfolios. Strategic financing solutions help minimize upfront costs, ensuring steady passive income and long-term investment success.

Financing Options for Rental Properties

- - Long-term residential rentals

- - Short-term vacation rentals

- - Commercial office spaces

- - Residential homes for fix-and-flip projects

Investment Property Loans vs. Conventional Home Mortgages

The lender will focus on your experience as an investor and your overall strategy, rather than placing heavy emphasis on your income, assets, and job history. Like a traditional loan, they will still review your credit, conduct an appraisal, and initiate the title process. Our platform streamlines the journey with clear guidance, user-friendly application steps, and state-compliant financing options, making it easier to secure rental property loans, vacation rental financing, or commercial real estate funding.

Rather than placing heavy emphasis on your income, assets, and job history, the lender will prioritize your experience as an investor and your overall strategy. However, just like with a traditional loan, they will still review your credit, order an appraisal, and initiate the title process.

Key Differences

Larger Down Payment

Investment property loans typically require a larger down payment, usually around 25%, though this can vary based on your credit score. In comparison, conventional home loans may require as little as 3%, especially with government-backed programs. Our platform simplifies the process, providing clear guidance, intuitive application steps, and state-compliant financing options, enabling investors to confidently secure rental property loans, vacation rental financing, and commercial real estate funding.

Higher Interest Rates

Rates for investment property loans are generally higher than those for conventional mortgages. They tend to be between 100 to 400 basis points higher. For example, if the rate on a traditional mortgage is 6.5%, an investment loan might come with a rate of 7.5% or more.

Cash Reserves

You'll likely need to demonstrate that you have liquid reserves to cover the down payment, closing costs, and 6-12 months of principal, interest, taxes, insurance, and any association fees. If you own other investment properties, some lenders may also require proof of reserves for each one. Conventional home loans typically require fewer reserves, ranging from none to six months.

Less Personal Documentation

For a traditional mortgage, lenders usually request detailed information about your employment history and personal income, including pay stubs and tax returns. Right before closing, they may ask you to confirm your employment status.

*With some investment property loans, this personal documentation is still required, especially if you already own other properties. However, other types of investment loans focus more on the income generated by the property itself, which simplifies the paperwork.

- Agency Loans for Investment Properties

- Regional Banks

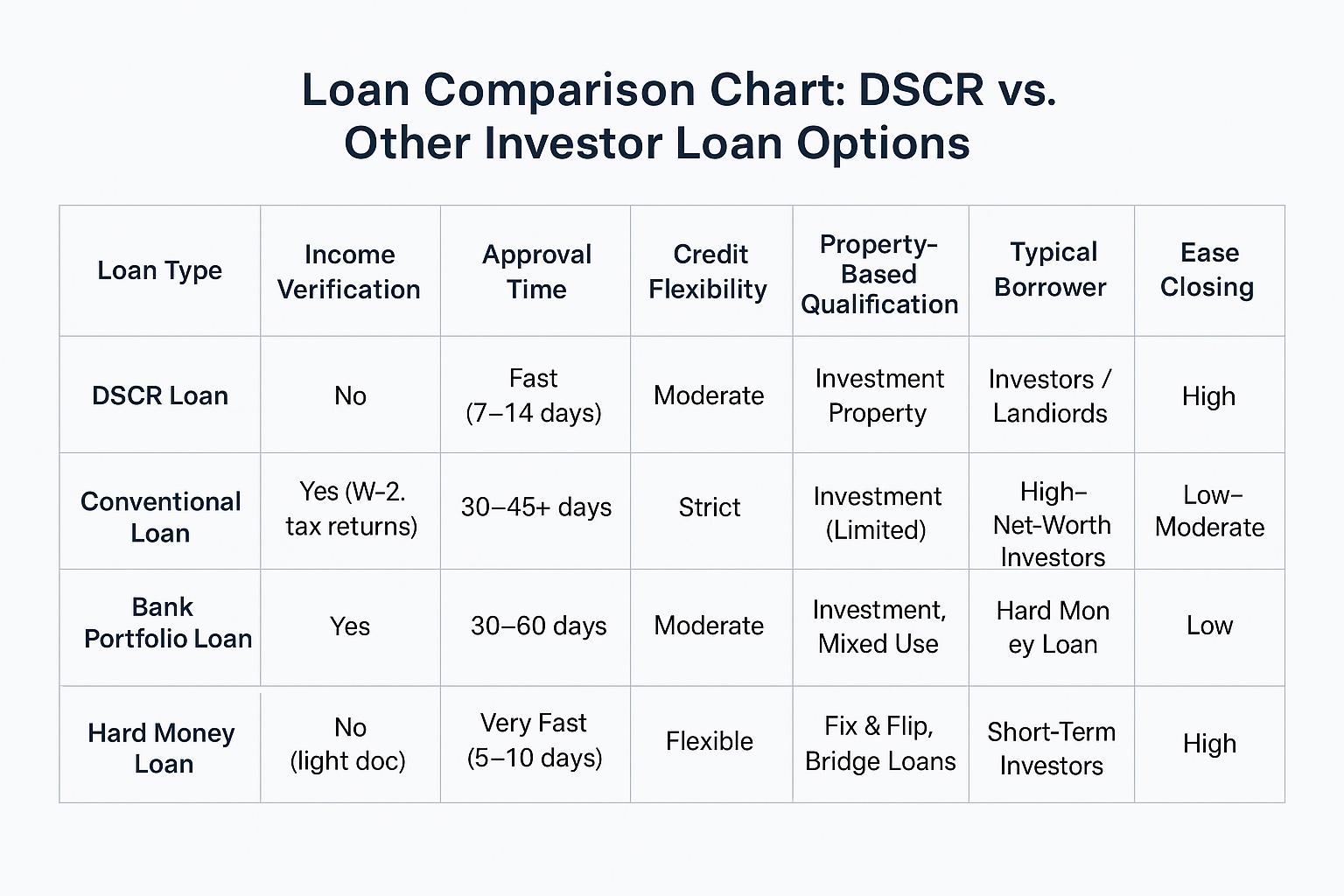

- Other Loan Options

- Investment Property Loan Qualifications

Agency loans are the most cost-effective option for financing investment properties, but they can be the most complex to secure. While obtaining one for your first investment property is relatively straightforward, acquiring additional properties becomes more challenging due to Fannie Mae's stringent guidelines. Our platform simplifies the process, offering clear guidance, easy application steps, and state-compliant financing solutions to help investors efficiently navigate rental property loans, vacation rental financing, and commercial real estate funding.

Lenders typically evaluate agency loans by considering an investor's overall cash flow. This includes both personal income from steady employment and net operating income from rental properties. However, these loans come with several challenges for investors: